If you applied for a credit card and got denied, or you saw an APR that made your stomach drop, you’ve already felt what a credit score can do without ever understanding what it is.

Here’s the honest truth: a credit score is not a “financial personality test.” It’s a math-based risk score built from your credit report that helps companies decide two things:

Do we approve you?

If yes, how expensive will this be for you?

That second part is where people lose real money.

A stronger score often means lower interest rates, smaller deposits, easier approvals, and more options. A weaker score usually means higher APRs, stricter terms, and a lot of “sorry, not at this time.”

This guide is structured around the exact questions beginners keep asking (the stuff that shows up repeatedly in “common questions” and help pages), with clear examples and practical steps you can use immediately.

Quick answers

A credit score is a prediction of how likely you are to repay on time, based on your credit reports.

Most common scores range from 300 to 850.

You do not have only one credit score; you have multiple scores depending on the bureau and scoring model.

For FICO scores, the biggest drivers are payment history (35%) and utilization (30%).

Checking your own report is a soft inquiry and does not hurt your score.

You can get free weekly credit reports from all three bureaus at AnnualCreditReport.com.

Credit score definition (plain English)

The Consumer Financial Protection Bureau (CFPB) puts it simply: a credit score is a prediction of your credit behavior, like how likely you are to repay a loan on time, based on information from your credit reports.

Plain English version: it’s a 3-digit risk score that helps lenders estimate how risky it is to lend you money.

That’s why credit scores are used for more than just credit cards. Companies may use scores for tenant screening and insurance decisions too (depending on the situation and state rules).

Credit score vs credit report (this is where beginners get stuck)

People mix these up constantly, so let’s make it clean.

A credit report is a detailed file that lists your credit accounts, balances, payment history, inquiries, and certain public records.

A credit score is the number created by running the information in your credit report through a scoring model.

Quick analogy

Credit report = your full transcript

Credit score = your GPA

Who creates your credit report?

Your credit data is collected by the three nationwide consumer reporting agencies (credit bureaus):

Experian

Equifax

TransUnion

Each bureau can have slightly different information because not every lender reports to all three, and reporting timing differs. That’s one reason your score varies depending on where you check it.

What is a good credit score? (ranges that matter)

There isn’t one universal “good” number because lenders set their own standards. But here’s a widely used beginner-friendly framework:

FICO score ranges (common reference)

300–579 = Poor

580–669 = Fair

670–739 = Good

740–799 = Very Good

800–850 = Exceptional

If you want one simple target as a beginner: aim for 670+ (good), then build from there.

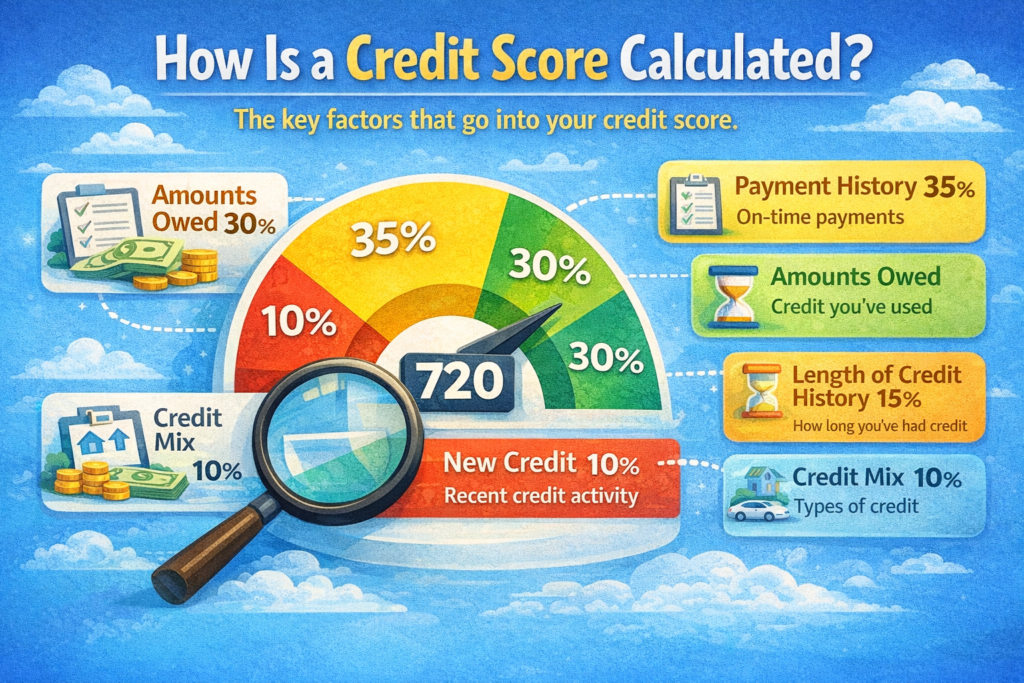

How is a credit score calculated? (the 5 factors beginners should know)

If you’re learning one section from this whole article, make it this one.

FICO, the most widely used scoring brand, groups information into five categories:

Payment history: 35%

Amounts owed / utilization: 30%

Length of credit history: 15%

New credit: 10%

Credit mix: 10%

Mini visual: FICO factor weights (approx.)

Payment history (35%) ███████████████████

Utilization (30%) █████████████████

Length (15%) █████████

New credit (10%) ██████

Credit mix (10%) ██████

Now let’s translate these into real life.

1) Payment history (35%): did you pay on time?

This is the single biggest factor. Late payments, collections, foreclosures, and bankruptcies can hurt the most.

Important beginner detail: most negative payment history can generally stay on your credit report for up to seven years.

Practical move

Set autopay for at least the minimum payment on every account. One missed due date can cost you far more than any rewards points you’ll ever earn.

2) Utilization (30%): how much of your credit limit are you using?

Utilization is mostly about credit cards.

Example

Card limit: $1,000

Statement balance: $450

Utilization: 45%

Many education sites use “under 30%” as a general guideline, and keeping it even lower often looks better.

Beginner tip that actually works

Your score reacts to what gets reported (often your statement balance), not how much you spend during the month. If you pay the balance down before the statement closes, you can show a lower utilization while still using the card normally.

3) Length of credit history (15%): how long have you been using credit?

Longer history helps because there’s more data showing how you manage credit.

Beginner rule of thumb

Avoid closing your oldest card if it has no annual fee and you can manage it responsibly. A longer track record can help.

4) New credit (10%): how often are you applying?

Opening several accounts in a short time can look risky.

Hard inquiries can have a small negative effect; soft inquiries (like checking your own report) do not.

5) Credit mix (10%): do you handle different types of accounts?

This looks at whether you have a mix of revolving (credit cards) and installment (auto, student, mortgage) accounts. You do not need one of everything to have good credit.

Why do I have so many different credit scores?

This is one of the most common beginner “wait, what?” moments.

Experian explains that scores vary because:

Each bureau has its own report data

FICO and VantageScore are different scoring systems

There are multiple versions within each system (including scores designed for auto loans, mortgages, and cards)

Some lenders use custom models

What to do with that information

Stop chasing a single “perfect” number. Focus on improving the fundamentals (on-time payments and low utilization). Strong habits tend to produce strong scores across models.

FICO vs VantageScore: which one matters?

Both are real scoring systems, and you might see one or the other depending on where you check your score.

FICO is commonly used in lending decisions.

VantageScore is also widely used and has been increasingly discussed in mortgage underwriting changes.

Mortgage note for 2026 (beginner-friendly, not scary)

Experian reports that as of July 2025, lenders selling loans to the government-sponsored enterprises can choose between VantageScore 4.0 and “classic” FICO scores for those mortgages, and that FICO 10 T is planned for future adoption.

If you’re not buying a home soon, you don’t need to obsess over this. The same habits that build FICO scores generally build healthier credit profiles overall.

Does checking my credit score hurt my credit?

Checking your own credit does not hurt your score.

The CFPB explains that soft inquiries include your own requests for your credit report and these do not affect your credit scores.

What can hurt (slightly) is when you apply for new credit and a lender pulls your report as part of a decision (a hard inquiry).

How can I check my credit report for free (the official way)?

Use AnnualCreditReport.com.

The FTC warns that other sites may charge or be fraudulent look-alikes, and confirms you can request free copies there.

The free weekly access matters because errors happen, and catching them early is easier than cleaning them up years later. The FTC explains the bureaus permanently extended free weekly reports.

How often is my credit score updated?

Generally, at least monthly, because most creditors report about once a month, but changes can happen more often if different lenders report on different days.

Beginner mindset shift

Credit isn’t a once-a-year test. It’s more like a monthly progress report.

How long does it take to build credit from scratch?

If you’re brand new (no credit history), it takes time to generate a score.

Experian says it can take several months to establish a credit score from scratch and longer to build a solid history.

American Express notes it may take a minimum of about six months to generate your first credit score, with longer timelines for strong credit.

So yes, you can make progress quickly, but “great credit” is usually the result of consistent habits over time.

Real numbers: how a credit score can change what you pay

A credit score matters because pricing changes fast as risk changes.

Here’s a concrete example using the same car loan amount but different interest rates.

Example: 6% vs 14% on a $15,000 car loan (60 months)

Loan amount: $15,000

Term: 60 months

At 6% APR

Monthly payment ≈ $290

Total interest ≈ $2,400

At 14% APR

Monthly payment ≈ $349

Total interest ≈ $5,941

Difference in interest: about $3,500 more for the higher rate

That is real money you don’t get back, and it’s why improving your score is one of the highest-return “adulting” projects you can do.

How can I improve my credit score? (beginner plan that’s not overwhelming)

Below is a practical, high-impact plan built around what scoring models actually weight most.

Step 1: Make on-time payments non-negotiable

Because payment history is the largest FICO category, this is priority #1.

Do this today

Turn on autopay for the minimum payment on every account. Then manually pay more when you can.

Step 2: Lower utilization the right way

Utilization is the second largest category.

Fast wins

Pay down balances before the statement closes

If you can’t pay in full, aim to stay under 30% utilization (and lower if possible)

Avoid maxing out a card even if you pay it off later; the reported balance can still hurt if it reports high

Step 3: Apply less, not more

New accounts and inquiries can temporarily lower your score.

Beginner rule

If you’re trying to build credit, don’t “spam apply.” Apply with purpose.

Step 4: Build credit safely if you’re new

If you have thin credit (or no credit), common beginner tools include:

A secured credit card (deposit becomes your limit)

An authorized user spot on a trusted person’s well-managed card

A credit-builder loan from a credit union or community bank

The goal is not to borrow a lot. The goal is to create a small, clean payment history.

Step 5: Monitor your reports and correct errors

Free weekly reports make this easier.

If something is inaccurate, dispute it with the bureau and, if needed, with the company reporting the information.

How do I dispute something on my credit report?

This is another top beginner question.

A clean, practical approach:

Get your reports from AnnualCreditReport.com and identify exactly what’s wrong.

Gather proof (statements, letters, payment confirmations).

Dispute with the bureau that shows the error (Experian, Equifax, or TransUnion).

Also dispute with the furnisher (the lender or collector) if needed.

If the negative item is accurate but you made a one-time mistake, a “goodwill” request to the lender sometimes works (not guaranteed, but worth trying if you otherwise have strong history).

Can I get a loan or credit card with bad credit?

Often yes, but you want to avoid traps.

What beginners commonly qualify for when rebuilding:

Secured credit cards

Starter cards with lower limits

Credit-builder loans

In some cases, co-signed loans (only if the relationship can handle that risk)

What to be careful with:

Very high annual fees with little benefit

Predatory “guaranteed approval” offers that add unnecessary costs

Loans you don’t actually need just to “build credit”

If you’re rebuilding, your best strategy is usually: one clean starter product + on-time payments + low utilization + time.

Important note about medical debt on credit reports (what’s changed recently)

Beginners ask this a lot because they’ve heard “medical debt doesn’t count anymore.”

Reality has been moving. Major bureaus previously removed medical collections under $500, and there has been policy and court activity around broader medical-debt reporting rules.

If medical collections are part of your situation, don’t rely on headlines. Pull your reports and see what’s actually listed, then address what’s there.

FAQs beginners actually ask (quick, human answers)

What’s the fastest way to raise my credit score?

For most beginners, the fastest improvement usually comes from lowering credit card utilization (paying balances down before the statement closes) and making every payment on time. Those two categories dominate FICO scoring.

Is it better to pay in full or carry a small balance?

Paying in full is financially best because you avoid interest. You do not need to carry interest-bearing debt to build credit. Your score can build from on-time payments and responsible usage.

Why did my score drop even though I paid everything on time?

Common reasons include a higher reported card balance (utilization), a new hard inquiry, a new account lowering average age, or an error on your report. Scores update as new data is reported, often monthly.

How long do late payments stay on my credit report?

The CFPB says negative information about payment history can generally be reported for up to seven years.

The impact usually fades over time if your recent history is strong.

How often should I check my credit?

If you’re actively building or fixing credit, checking monthly is reasonable. Checking your own report is a soft inquiry and does not hurt your score.

At minimum, pull all three reports at least once a year, and more often if you’re applying for a major loan.

Conclusion: credit scores stop being scary when you know what they measure

A credit score is not a mystery number that randomly rises and falls. It’s a predictable output from your credit report data.

If you’re a beginner, here’s the clean priority list:

Never miss a payment

Keep credit card utilization low

Apply for new credit intentionally

Build a small, positive history and let time work

Check your reports for errors using the official free source