You can do everything “right” with credit and still get nervous when a form asks, “May we check your credit?”

Because one type of credit check is basically harmless, and the other can temporarily nudge your score down and show up to lenders as a sign you’re applying for new credit.

If you’re applying for a card, renting an apartment, shopping for a car loan, or using pre-approval tools, this guide will help you answer the questions people actually ask, without the jargon.

Quick answer (most people just want this)

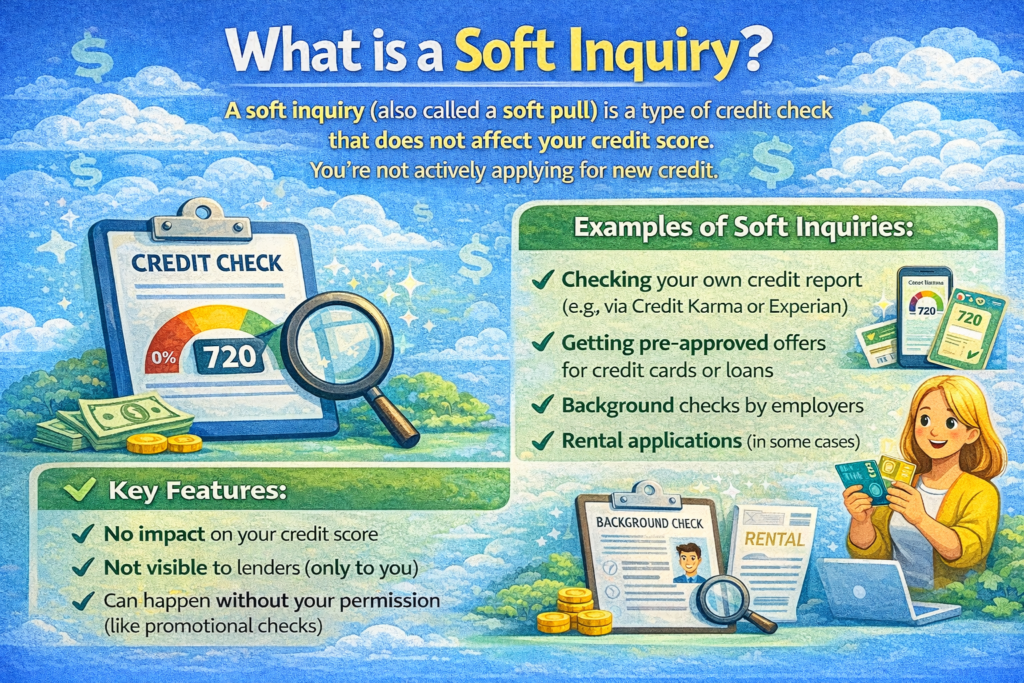

A soft inquiry is a credit check that does not affect your credit scores and is typically visible only to you on your credit report.

A hard inquiry happens when you apply for new credit and a lender checks your report for a lending decision; it can slightly lower your score and is visible to lenders.

Hard inquiries can remain on your credit report for up to two years, but most scoring impact fades sooner (often within months, and many models stop counting them after about 12 months).

Soft inquiry vs hard inquiry (simple comparison table)

| Topic | Soft inquiry (soft pull) | Hard inquiry (hard pull) |

|---|---|---|

| Common reason | Pre-approval offers, account reviews, employment/tenant screening, you checking your own report | Applying for a credit card, mortgage, auto loan, personal loan |

| Affects credit score? | No | Can slightly lower it |

| Visible to lenders? | Generally no (mostly visible only to you) | Yes |

| How long it stays | Can remain on your report (varies; often up to 2 years depending on type) | Up to 2 years |

What is a soft inquiry?

A soft inquiry is a review of your credit file that is not tied to a specific credit application decision.

The CFPB lists common examples such as reviews by existing lenders or insurers, prescreening for promotional offers, employment screening, and your own requests for your credit reports, and notes these do not affect your credit scores.

TransUnion describes soft inquiries as promotional or account review inquiries and notes they may appear when an insurer, employer, landlord, or you check your credit.

Common situations that usually trigger a soft inquiry

Checking your own credit report or credit monitoring

Credit card “pre-approval” or “pre-qualification” checks (often, but not always)

Existing lender account reviews (your bank checks your report while you’re already a customer)

Employment background checks (where permitted and with required disclosures/permission depending on the process)

Insurance underwriting checks (commonly soft inquiries for credit-based insurance scores, where allowed)

What is a hard inquiry?

A hard inquiry happens when you apply for credit and the lender checks your credit report to decide whether to approve you (and sometimes what terms to offer).

The CFPB explains hard inquiries are often made by lenders after you apply for credit, and they can impact your credit score because models look at how recently and frequently you apply.

Experian also describes hard inquiries as occurring during the credit application process and notes they can temporarily lower scores.

Common situations that usually trigger a hard inquiry

Applying for a credit card

Applying for a mortgage

Applying for an auto loan

Applying for a personal loan or line of credit

Sometimes requesting a credit limit increase (issuer-dependent)

Does a soft inquiry affect your credit score?

No.

The CFPB is very direct: soft inquiries do not affect your credit scores.

That includes you checking your own credit report.

Practical implication: you do not need to be afraid of checking your own credit.

How many points does a hard inquiry lower your credit score?

Usually, not many points for a single inquiry, and the effect often fades if the rest of your credit behavior stays strong.

Experian notes one hard inquiry will typically reduce your score by fewer than five points, and that scores often rebound within a few months.

American Express similarly notes the impact is typically small (often less than five points) and should not affect your score for more than about a year.

Two important caveats

Multiple hard inquiries close together can have a compounding effect, especially if you’re also opening several new accounts.

If your credit file is thin (new credit history), you may feel the impact more than someone with a long, strong history.

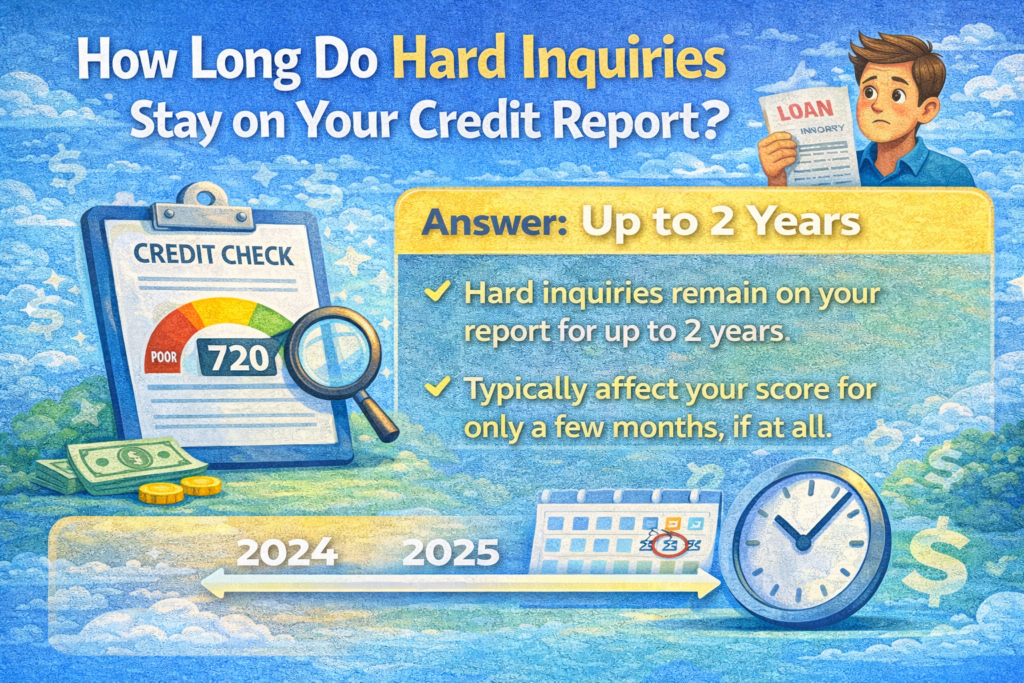

How long do hard inquiries stay on your credit report?

Hard inquiries can remain on your credit report for up to two years.

But “stays on the report” and “affects the score” are not always the same thing.

MyFICO explains that while hard inquiries typically remain on the report for up to two years, FICO Scores generally only consider inquiries from the last 12 months.

Experian also notes many scoring models stop counting a hard inquiry after 12 months.

What is “rate shopping,” and how do you avoid multiple inquiry hits?

This is one of the most important sections for beginners because it can save your score while you shop for a good deal.

Credit scoring models generally recognize that consumers shop around for a single loan (like one auto loan) and may treat multiple inquiries as one if they occur within a short window.

The CFPB explains that scoring models generally count multiple inquiries as one when they occur within a reasonably short period and gives a general range of 14–45 days for the same type of loan, and notes certain mortgage/auto/student inquiries in the 30 days prior to scoring may have no effect in common models.

MyFICO describes a rate-shopping window of 45 days for newer FICO versions (and 14 days for older versions) for mortgage, auto, and student loan shopping.

TransUnion notes that for VantageScore 3.0, the window is 14 days and encourages bunching inquiries in a short time frame.

What this means in real life

If you’re shopping for a car loan, do your applications close together (think days, not months).

Do not spread the same loan shopping across many weeks unless you are okay with potentially multiple inquiries being counted.

Important: this rate-shopping treatment generally applies to certain installment loans (auto/mortgage/student), not credit cards. Experian notes credit card applications are typically counted separately.

Is pre-qualification a soft inquiry or a hard inquiry?

Usually a soft inquiry, but not always.

Experian notes that prequalification typically involves a soft inquiry, but you should confirm because some “pre-approval” processes can still lead to a hard pull at the formal application stage.

MyFICO also describes pre-approved offers as soft-inquiry situations.

A simple rule that prevents surprises

If a site says “check your rate” or “see if you’re prequalified,” it’s often soft.

If you click “submit application,” expect a hard inquiry.

If you are unsure, look for wording like “this will not affect your credit score” (soft) versus “by submitting you authorize a credit check” (often hard).

Can a landlord or employer do a hard inquiry?

It depends on what process they use.

TransUnion notes tenant screening and employment checks can show up as soft inquiries.

Experian notes renting or leasing can be either hard or soft depending on the landlord/leasing company and advises checking.

What you should do

Ask directly: “Is this a soft or hard credit inquiry?”

If it’s hard, ask whether they can use a screening process that does not create a hard inquiry.

Can someone check your credit without permission?

For hard inquiries tied to new credit, you generally provide permission as part of applying.

The CFPB explains that for credit cards, a company can look at your full report when you apply (hard inquiry), and existing issuers can look for account management purposes (soft inquiry), and emphasizes “permission” in the application context.

TransUnion notes lenders can access your report only with a “permissible purpose,” meaning a reason allowed by law.

If you see an unfamiliar hard inquiry, treat it seriously and investigate (see the section below).

What should you do if you see a hard inquiry you don’t recognize?

This is a very common “people also ask” problem, and it matters because it can be a fraud signal.

TransUnion notes an unfamiliar hard inquiry could be a sign of fraud and suggests contacting the lender listed on the report as a first step.

Experian similarly notes suspicious inquiries may indicate attempted fraud and outlines contacting the creditor and disputing if needed.

Action steps

Pull your credit reports and identify the creditor name tied to the inquiry.

Contact the creditor using official contact info (not a random number in an email).

Check for any new accounts you didn’t open.

Dispute the inquiry with the credit bureaus if it appears unauthorized.

Consider placing a fraud alert or security freeze if you suspect identity theft.

How to minimize hard inquiries without “avoiding credit forever”

Use pre-qualification tools when available (often soft inquiries).

Bundle auto/mortgage/student shopping into a short window (rate shopping).

Space out credit card applications if you are applying for multiple cards, since they generally do not get grouped like rate shopping.

Apply with purpose: only when the product fits your plan (not because of a limited-time banner ad).

Monitor your credit so you can spot unauthorized inquiries quickly.

FAQs (real questions beginners ask)

Does checking my own credit score hurt my credit?

Checking your own credit report is a soft inquiry and does not affect your credit scores.

How long do hard inquiries affect your score?

Hard inquiries can stay on your report up to two years, but scoring impact is typically shorter. MyFICO notes FICO Scores generally consider inquiries from the last 12 months.

How many hard inquiries is too many?

There is no universal number. The risk is when you stack multiple inquiries and new accounts close together, which can signal higher risk to scoring models and lenders.

If you must shop, bundle loan shopping into the rate-shopping window rather than spreading it out.

Can you remove a hard inquiry?

You generally cannot remove a legitimate hard inquiry. You can dispute inquiries you believe are unauthorized or incorrect.

Why do I see a “soft inquiry” from a company I never applied to?

Prescreening for promotional offers can create soft inquiries, and the CFPB notes prescreening inquiries are a type of soft inquiry.

These do not affect your credit score.

Conclusion: Treat hard inquiries like a tool, not a threat

Soft inquiries are routine background checks that do not affect your score.

Hard inquiries are the ones to manage thoughtfully because they can cause a small, temporary score dip and signal active credit seeking.

If you remember three rules, you’ll avoid most surprises:

Use pre-qualification when possible to keep checks soft.

Rate-shop loans inside a short window so multiple pulls count as one.

Investigate any hard inquiry you do not recognize immediately.