You can have perfect payment history and still see your score dip after doing something that felt responsible, like opening a new credit card for better rewards or a balance transfer.

That’s often the “age” factor showing up.

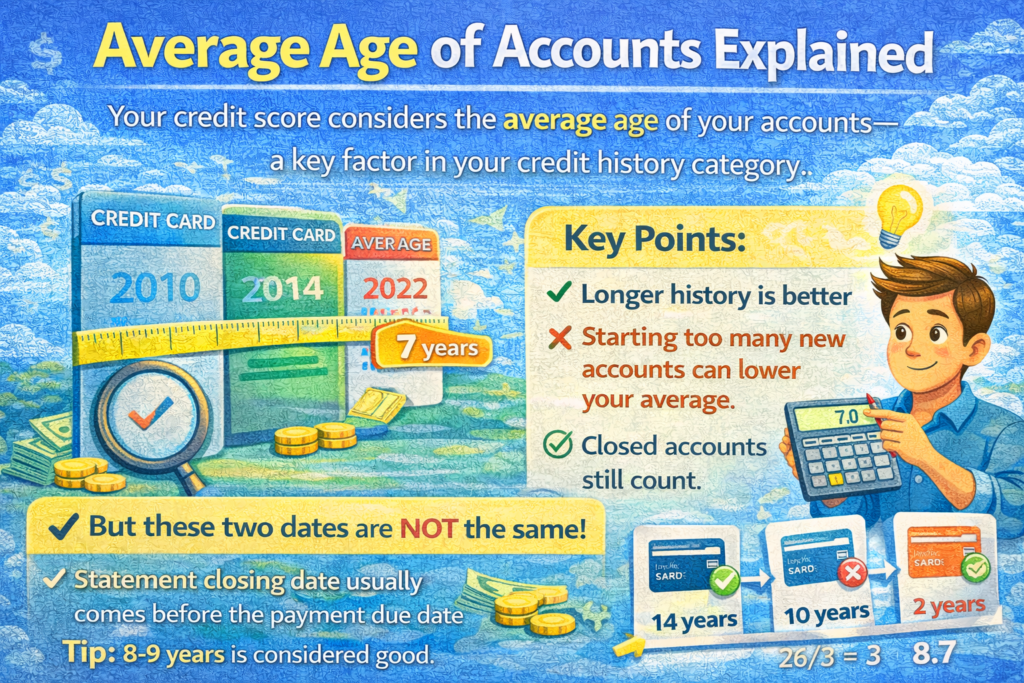

Credit scoring models don’t just care whether you pay on time. They also care how long you’ve been managing credit. A longer track record generally helps because it gives lenders more evidence of stability. The CFPB notes that a long credit history helps your credit score because scores are based on experience over time.

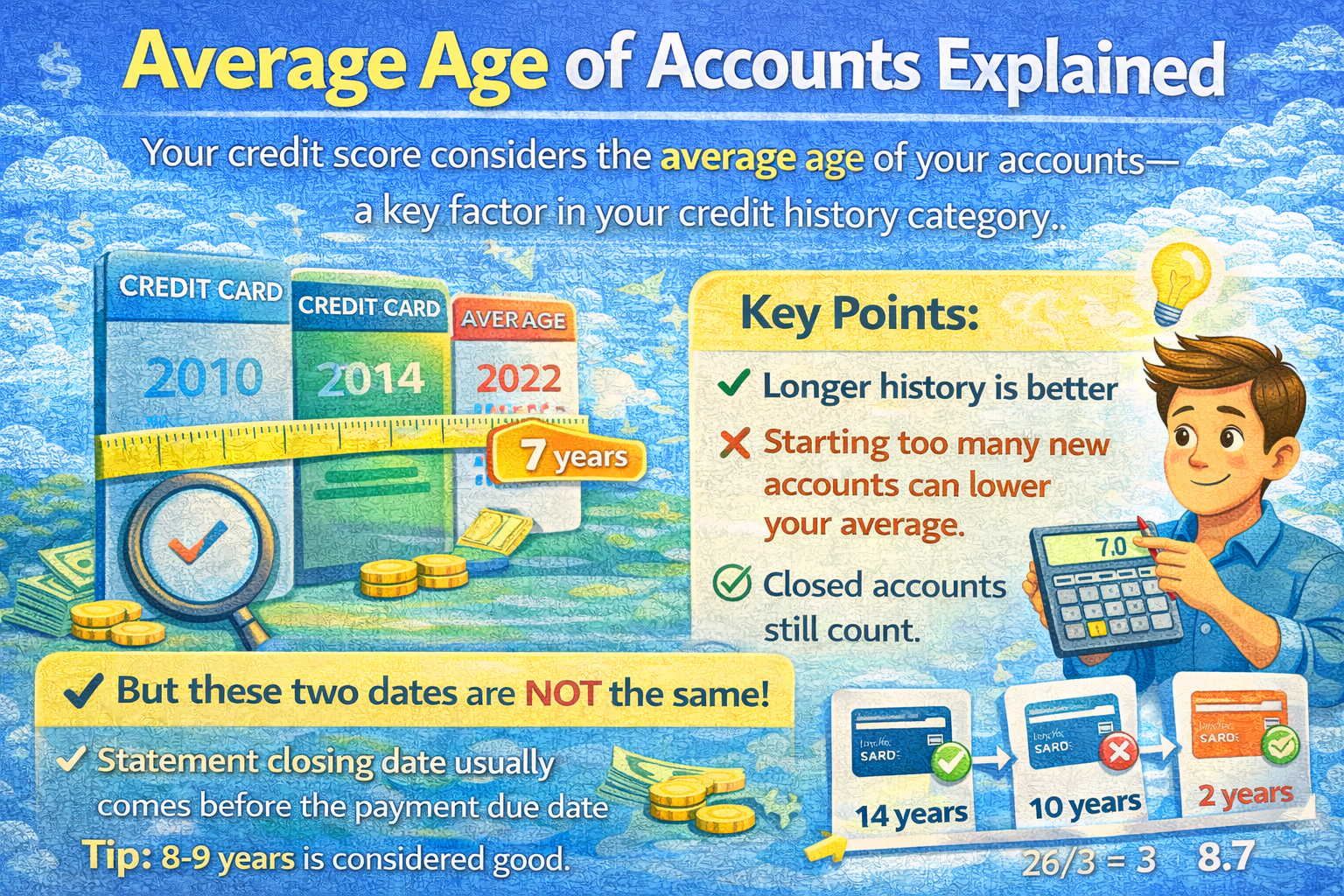

One of the simplest ways to describe that track record is your average age of accounts (often shown as AAoA). It’s not the only age metric, but it’s one of the most talked-about because it changes when you open new accounts and, eventually, when old accounts fall off your credit reports.

This guide answers the questions people commonly ask, with clear examples and practical decisions you can make without guessing.

Key takeaways

Average age of accounts is the average time your credit accounts have been open; it’s part of the broader “length of credit history” factor.

Length of credit history is about 15% of a FICO Score, and FICO looks at the age of your oldest account, newest account, and average age of accounts.

Opening new credit can lower your average age, which can temporarily lower your score.

Closing an account usually doesn’t erase its positive history right away because closed accounts can remain on your credit reports for up to about 10 years and can continue impacting scores during that time.

What is the average age of accounts?

Average age of accounts (AAoA) is exactly what it sounds like: the average time your credit accounts have been open.

If you view your credit file through Experian, for example, you may see the average age of accounts listed directly, along with your oldest account age.

AAoA matters because it reflects whether your credit history is “seasoned” or “new.” Newer files are riskier to lenders because there’s less evidence of how you handle debt over time.

How does average age of accounts affect your credit score?

AAoA is not a standalone scoring category by itself, but it feeds into the “length of credit history” portion of your score.

FICO explains that the length of your credit history considers how long your accounts have been open, including the age of your oldest account, newest account, and an average age of accounts.

Experian similarly describes average age of accounts as a key component of how length of credit history is evaluated.

Practical implication: if you open new credit often, your average age drops and you can lose some points, even if you pay perfectly.

Also important: FICO notes that length of history is only about 15% of your FICO Score, so it matters, but it is usually not the biggest driver compared with payment history or utilization.

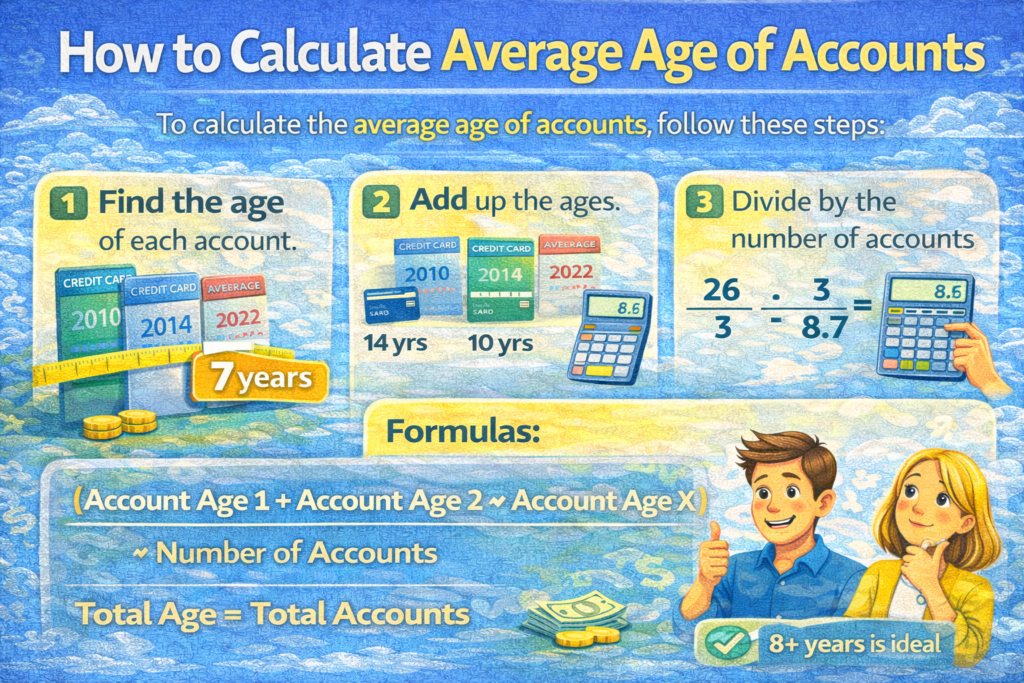

How to calculate average age of accounts (with easy examples)

Experian explains the basic method: calculate the months since each account was opened, add them up, then divide by the number of accounts.

Example 1: Three accounts

Assume today is January 2026.

Card A opened: January 2022 → 48 months

Card B opened: January 2024 → 24 months

Loan C opened: January 2025 → 12 months

Total months = 48 + 24 + 12 = 84

Number of accounts = 3

AAoA = 84 ÷ 3 = 28 months

28 months = 2 years, 4 months

Example 2: What happens when you open a new card?

Using the same accounts above, you open a new card in January 2026 (0 months old).

New total months = 84 + 0 = 84

New number of accounts = 4

New AAoA = 84 ÷ 4 = 21 months

Your AAoA drops from 28 months to 21 months immediately. That drop can reduce your score temporarily, even if everything else stays the same. MyFICO explicitly notes that opening new credit lowers the average age of accounts and can lower your score.

What is a “good” average age of accounts?

There’s no single AAoA number that automatically equals “good credit,” because lenders look at your entire profile and different scoring models weigh factors differently.

What you can say confidently, based on how scoring works:

Longer is generally better. MyFICO says that a longer credit history tends to have a positive effect on FICO Scores.

You can still have a strong score with a shorter history if the rest of your report is excellent. MyFICO notes that even some people with shorter histories can still have high scores if the rest of the report looks good.

A helpful “beginner-friendly” way to think about AAoA is by stages:

Under 1 year: very new credit file (expect more sensitivity to changes)

1–3 years: building stage (scores can be solid if utilization and payments are strong)

3–7 years: more established (age starts working in your favor)

7+ years: seasoned (age is rarely your main weakness)

Those ranges aren’t official cutoffs. They’re a way to set expectations: if you’re early in the journey, your score will swing more when you open new accounts.

Does opening a new credit card lower your average age of accounts?

Yes, usually.

A new account reduces your AAoA because you just added a “0-month-old” account to your average. MyFICO explains that opening new credit lowers the average age of your total accounts, which can lower your credit score.

That does not mean you should never open new credit. It means you should open it with timing and purpose.

When opening a new account is still worth it:

You need to build credit and you have a thin file (a new account can help long-term)

You’re getting a large, lasting benefit (lower APR, valuable rewards, better protections)

You’re consolidating expensive debt with a balance transfer (and have a payoff plan)

When you should be cautious:

In the months before applying for a mortgage or major loan, because new accounts can lower age and also add inquiries

Does closing a credit card hurt your average age of accounts?

This is one of the most searched questions, and the honest answer is: it depends on timing and your credit report.

Experian notes that closing a credit card can hurt your credit, including by lowering your average age of accounts.

However, closing a card does not necessarily remove it from your credit report immediately. Experian explains that closed accounts can stay on your credit reports for up to 10 years and continue impacting your scores during that period.

What that means in practical terms:

Short term: closing a card may not instantly drop AAoA if the account remains on your report and continues to be included in aging metrics

Long term: when that closed account eventually falls off your reports, your AAoA can drop because you lose an older account from the average

Also, closing a card can hurt your score for another reason: it can reduce your total available credit and raise utilization, which is a major scoring factor.

A practical rule for beginners:

If a card has no annual fee and you can manage it responsibly, keeping it open often helps your credit profile over time.

Do closed accounts still count toward average age of accounts?

Usually, yes while they remain on your credit report.

Experian says closed credit accounts can remain on credit reports for up to about 10 years and continue to impact your credit scores during that period.

Other major consumer sources also commonly explain that closed accounts can stay on reports for years (often 7–10 depending on the account) and can still affect credit during that time.

This is why “closing a card immediately tanks your AAoA” is often an oversimplification. The bigger immediate risk is usually utilization, not age.

Does average age of accounts include loans or just credit cards?

AAoA typically reflects the age of accounts on your credit report, which can include both revolving accounts (credit cards) and installment accounts (auto loans, student loans, mortgages), depending on how the scoring model evaluates your file.

MyFICO describes length of history in terms of credit accounts generally, including oldest, newest, and average age of accounts.

If you want a clean approach as a beginner:

Assume both cards and loans contribute to your overall age picture, and focus on the behavior that helps across the board: on-time payments and careful new account timing.

How fast can average age of accounts improve?

AAoA improves slowly because time is literally the input.

Every month that passes, each account gets one month older. Your AAoA rises as your accounts age, and it rises faster if you stop adding brand-new accounts.

This is why “credit age” is the part you can’t hack quickly. What you can do quickly is avoid unnecessary resets by opening fewer accounts.

How to improve your average age of accounts without hurting your credit

Here are realistic, lender-friendly strategies.

1) Slow down new applications

Because new accounts reduce AAoA, spacing out new credit applications is one of the simplest ways to protect your average age. MyFICO notes that opening new credit lowers average age of accounts.

If you’re a beginner, “fewer, better accounts” usually beats “many accounts fast.”

2) Keep older accounts open when it makes sense

Keeping long-standing accounts open helps preserve your age metrics over time. Experian notes length of credit history matters, and it’s generally influenced by how long accounts have been open.

If you don’t want to use an old card, put one small recurring charge on it (like a streaming subscription) and set autopay to pay it off.

3) Consider product-changing instead of opening a new card

If your goal is a better rewards structure, many issuers allow a “product change” (switching to a different card in the same family) without opening a brand-new account. This can help avoid a new account impacting AAoA (issuer rules vary, so confirm first).

4) Be careful with authorized user strategies

Some people add a family member as an authorized user to help build credit history. This can help in some situations, especially for thin files, but it depends on whether the issuer reports authorized user data and how scoring models treat it.

If you do it:

Only do it with someone who has a long, clean history and low utilization, because their behavior can reflect on your file.

5) Focus on bigger scoring factors first

Remember: age is important, but it’s not the largest slice.

FICO states payment history is 35% of the score, and length of history is about 15%.

So if you’re choosing where to spend effort, prioritize never missing a payment and keeping utilization reasonable, then optimize age.

Common myths about average age of accounts

Myth: You should never open a new account because it lowers AAoA

Reality: New credit can still be beneficial; the goal is intentional timing, not avoidance.

Myth: Closing a card instantly wipes out its age benefit

Reality: Closed accounts can remain on your report for years and can still influence scores during that time.

Myth: AAoA is the only “age” metric that matters

Reality: FICO also considers oldest and newest account age, not just the average.

FAQs

What is the average age of accounts in a credit report?

It’s the average length of time your credit accounts have been open. Some credit report views (including Experian’s) display this metric directly.

How much does average age of accounts affect your credit score?

It is part of the broader “length of credit history” factor. For FICO Scores, length of credit history is about 15% of the score.

Will opening a new credit card lower my credit score even if I don’t use it?

It can, because opening new credit lowers average age of accounts, and new accounts may also involve inquiries and reduce average account age.

Does closing a credit card hurt credit age?

It can, but often not immediately for credit age. Closed accounts may stay on your report for up to about 10 years and can continue impacting scores during that period.

The more immediate risk from closing a card is often higher utilization if your total available credit drops.

Do closed accounts still count toward average age?

Typically yes while they remain on your credit report, which can be years.

How can I build credit without hurting my average age too much?

Open fewer accounts, keep older accounts open when practical, and focus on on-time payments and utilization. New accounts can help build credit, but spacing them out helps protect your average age.

Conclusion

Average age of accounts matters because it measures stability. It is part of the length-of-credit-history factor, and FICO evaluates age using your oldest account, newest account, and average age across accounts.

If you want a simple, reliable plan:

Protect your oldest accounts when they’re low-cost to keep (especially no-fee cards)

Open new accounts strategically, not impulsively

Prioritize payment history and utilization first, because they weigh more heavily than age in FICO scoring