If you’ve ever paid your credit card “on time” and still watched your credit score dip, you’re not imagining things. In many cases, the problem is not whether you pay. It’s when your balance gets recorded.

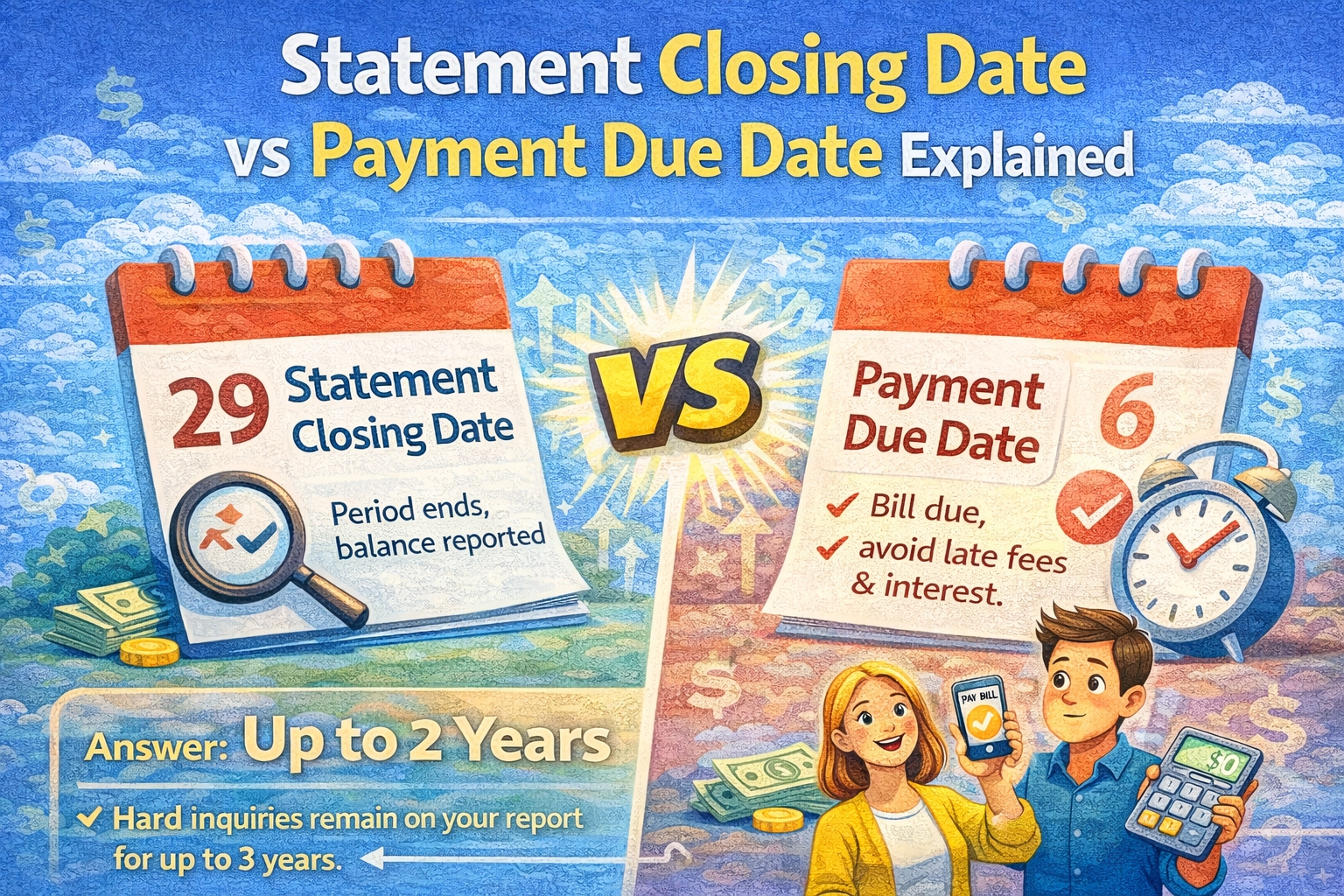

Two dates run your entire credit card life:

The statement closing date (when your monthly bill is created)

The payment due date (when that bill must be paid to avoid late fees and protect your grace period)

Once you understand how these dates work, you can do three useful things:

Avoid interest charges more reliably

Prevent accidental late payments

Control credit utilization (which can move your score quickly)

This guide covers the questions beginners ask most, with clear examples and a simple “what to pay, and when” plan.

Quick summary

Statement closing date = last day of your billing cycle; your statement balance is calculated then.

Payment due date = the deadline to pay at least the minimum (and ideally the full statement balance).

Your grace period is the time between the end of the billing cycle and the due date; you may avoid interest if you pay the statement balance in full by the due date (if your card offers a grace period).

Credit utilization is commonly calculated using your most recent statement balance, which is why timing matters for scores.

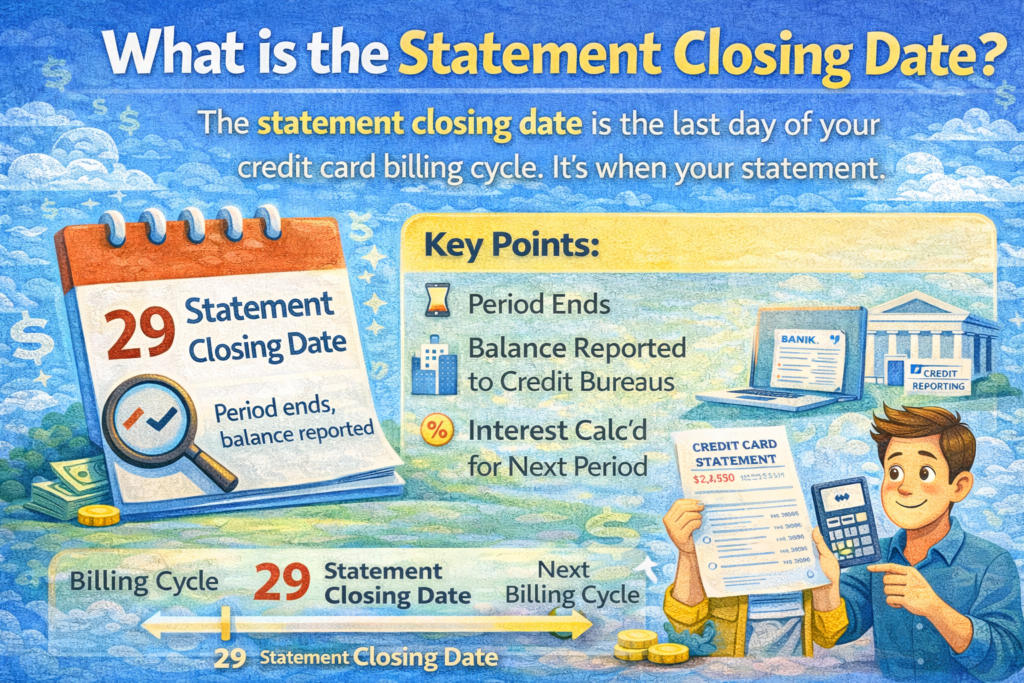

What is the statement closing date?

The statement closing date is the last day of your credit card billing cycle. It’s the date your card issuer “closes” the cycle and generates your monthly statement, including the new balance at that point.

What happens on (or right after) the closing date:

Your statement balance is set (this is the amount your bill is based on)

Your minimum payment is calculated

Your statement becomes available (paper or digital)

Important: purchases made after the statement closes typically go on the next month’s statement.

What is the payment due date?

The payment due date is the deadline for making your payment for that statement cycle. At minimum, you must pay the minimum payment by this date to avoid being treated as late.

The due date matters because missing it can lead to:

Late fees and penalty APR (depending on your card terms)

Negative credit reporting if you become 30+ days late (the bigger damage usually starts at 30 days)

Federal rules also require card issuers to give you time: statements must be sent far enough ahead that payments received within 21 days after the statement is mailed or delivered are not treated as late for any purpose.

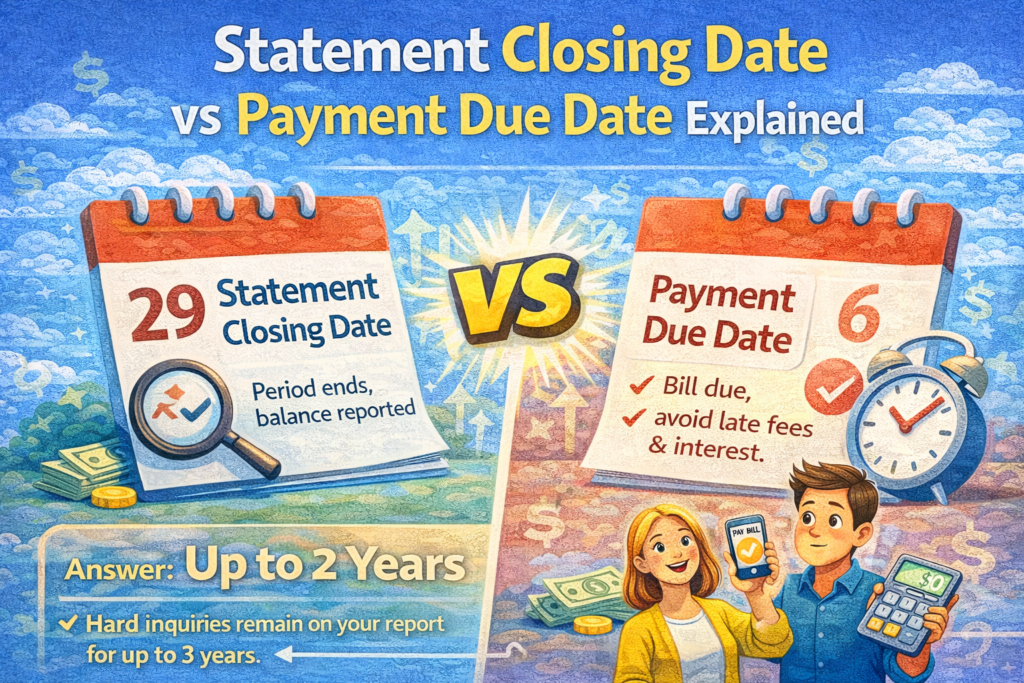

Statement closing date vs due date (the simple difference)

Think of it like a utility bill:

Statement closing date = the meter reading date (your usage gets totaled)

Due date = the day you must pay that bill

They are not the same, and they do different jobs.

A good way to visualize it:

Billing cycle ends → statement closes → statement balance is created → grace period (if you have one) → payment due date

Why it matters: 3 real reasons (interest, credit score, and cash flow)

1) It determines whether you pay interest (grace period)

The CFPB explains that a credit card grace period is the time between the end of the billing cycle and the due date, and during this time you may not be charged interest if you pay your balance in full by the due date (though issuers are not required to offer a grace period).

What that means in practice:

If you pay the full statement balance by the due date, you can usually avoid interest on purchases (on cards with a grace period).

If you do not pay the statement balance in full, you may lose the grace period and interest can start accruing differently depending on the card and balance type.

2) It affects your credit utilization (and your credit score)

Many people assume, “I pay in full, so my utilization should be low.” Not necessarily.

Experian explains that credit utilization is calculated using your card’s most recent statement balance.

So the balance that matters most for utilization is often the balance that exists at the statement closing date (the one that becomes your statement balance), not the balance after you pay on the due date.

That’s why your score can dip even when you never pay a cent of interest.

3) It helps you plan your money (and avoid accidental late payments)

If you only look at the due date, it’s easy to forget that your “bill amount” was locked in earlier at the closing date. Understanding both dates helps you:

Avoid surprise large statement balances

Decide when to pay early vs on the due date

Make autopay work correctly (minimum vs statement balance vs fixed amount)

The most common beginner confusion: statement balance vs current balance

This matters because people often pay the wrong thing.

Statement balance = the amount shown on your statement at the end of the billing cycle.

Current balance = what you owe right now, including recent purchases after the statement closed.

If your goal is to avoid interest on purchases (and your card has a grace period), paying the statement balance in full by the due date is usually the key move.

Example timeline (with real numbers)

Let’s say your card has:

Statement closing date: March 10

Payment due date: April 4

You spend:

March 1–10: $900

March 11–April 4: $300

What happens:

On March 10, the billing cycle closes. Your statement balance becomes $900.

Your due date is April 4. If you pay $900 by April 4, you typically avoid interest on those purchases (grace period rules apply).

The $300 spent after March 10 usually goes on the next statement, not the one due April 4.

Why your credit score might change:

Your utilization is commonly calculated using the most recent statement balance ($900).

If your credit limit is $1,000, that statement balance reports as roughly 90% utilization, even if you pay the full $900 on April 4.

This is the exact reason people say: “I paid in full, why did my score drop?” Timing.

When should you pay? The “best” strategy depends on your goal

Goal 1: Avoid interest and late fees (most people)

Pay the full statement balance by the due date.

This is the cleanest, most reliable habit for long-term credit health, and it’s what most people should do if they can. It also aligns with the way grace periods typically work on purchases.

Best practice:

Set autopay to “statement balance” if your issuer offers it

Keep a calendar reminder 3–5 days before the due date to confirm it processed

Goal 2: Make your credit utilization look lower next month (score optimization)

Pay before the statement closing date.

Because utilization is commonly based on the most recent statement balance, paying down your balance before the statement closes can make the reported number smaller.

A simple approach:

Use your card normally

About 2–5 days before the statement closes, make a payment to bring the balance down (for example, under 30% or under 10% of your limit)

Then pay the remaining statement balance by the due date

This is especially helpful if you are about to apply for a mortgage, car loan, or apartment.

Goal 3: Keep budgeting simple (steady routine)

Pay twice a month.

If your card limit is small or your spending is high, a mid-cycle payment keeps your balance from building up and reduces the chance your statement balance reports high.

A practical schedule:

Mid-cycle payment (around the 15th)

Pre-closing payment (a few days before the statement closes)

Then autopay the statement balance on the due date

How to find your statement closing date and due date

Most issuers show both in your online account or app.

Look for:

“Statement closing date” or “Statement date”

“Payment due date”

You can also find them on your PDF statement. Many banks also publish consumer education pages explaining these terms (for example, Citi and Discover both describe closing dates and due dates in their guides).

Can you change your payment due date?

Often, yes. Many issuers let you request a different due date (within certain limits). The closing date may shift too, because it’s tied to the billing cycle.

If your due date constantly falls right before payday, changing it can reduce late-payment risk, which matters more than “perfect” utilization.

Common mistakes to avoid

Paying only the minimum because “I paid something” (this can trigger interest and keep balances high)

Assuming the due date controls utilization (often the statement balance controls it)

Paying on the due date every month without a buffer (weekends, holidays, processing delays)

Letting autopay run without checking it posted (rare failures happen, and late payments are expensive)

FAQs (what people actually ask)

Is the statement closing date the same as the due date?

No. The statement closing date ends the billing cycle and sets your statement balance. The due date is when that statement payment is due.

If I pay right after the statement closes, does that help my credit score?

It can help your finances and prevents interest if you pay the statement balance by the due date, but it may not lower the utilization that already got captured in the statement balance for that cycle. Utilization is commonly calculated using the most recent statement balance.

To lower the reported utilization for a specific cycle, you typically pay down before the statement closing date.

I pay my card in full every month. Why did my score drop?

Often because your statement balance was high relative to your limit when the cycle closed, and utilization is commonly calculated from that statement balance.

Do I have to pay the current balance or the statement balance?

To avoid interest on purchases (on cards with a grace period), paying the statement balance in full by the due date is usually sufficient.

Paying the current balance can be fine too, but it is not required for most people.

What is a credit card grace period, exactly?

The CFPB defines it as the period between the end of the billing cycle and the payment due date; during this time you may not be charged interest if you pay your balance in full by the due date (if your card offers a grace period).

Conclusion:

Most credit card stress comes from treating the due date as the only date that matters. In reality:

The statement closing date determines what gets billed and often what gets reported

The due date determines whether you pay late and whether you keep your grace period

A simple, high-quality routine is:

Pay down before the statement closing date if you want lower utilization

Pay the full statement balance by the due date to avoid interest and late fees