Credit utilization is one of the fastest-moving parts of your credit score. You can do everything “right” (pay on time, never carry interest) and still see your score swing because the balance that got reported that month was higher than usual.

The good news is this is also one of the easiest levers to control once you understand two things:

Most scoring models care about how much of your available revolving credit you’re using, and “amounts owed” is a major part of scoring (about 30% of a FICO Score).

Utilization is usually calculated from your most recent statement balance as it appears on your credit report, not necessarily what you owe today.

This guide is built around what beginners actually ask, with simple math and realistic targets you can use immediately.

Quick takeaways

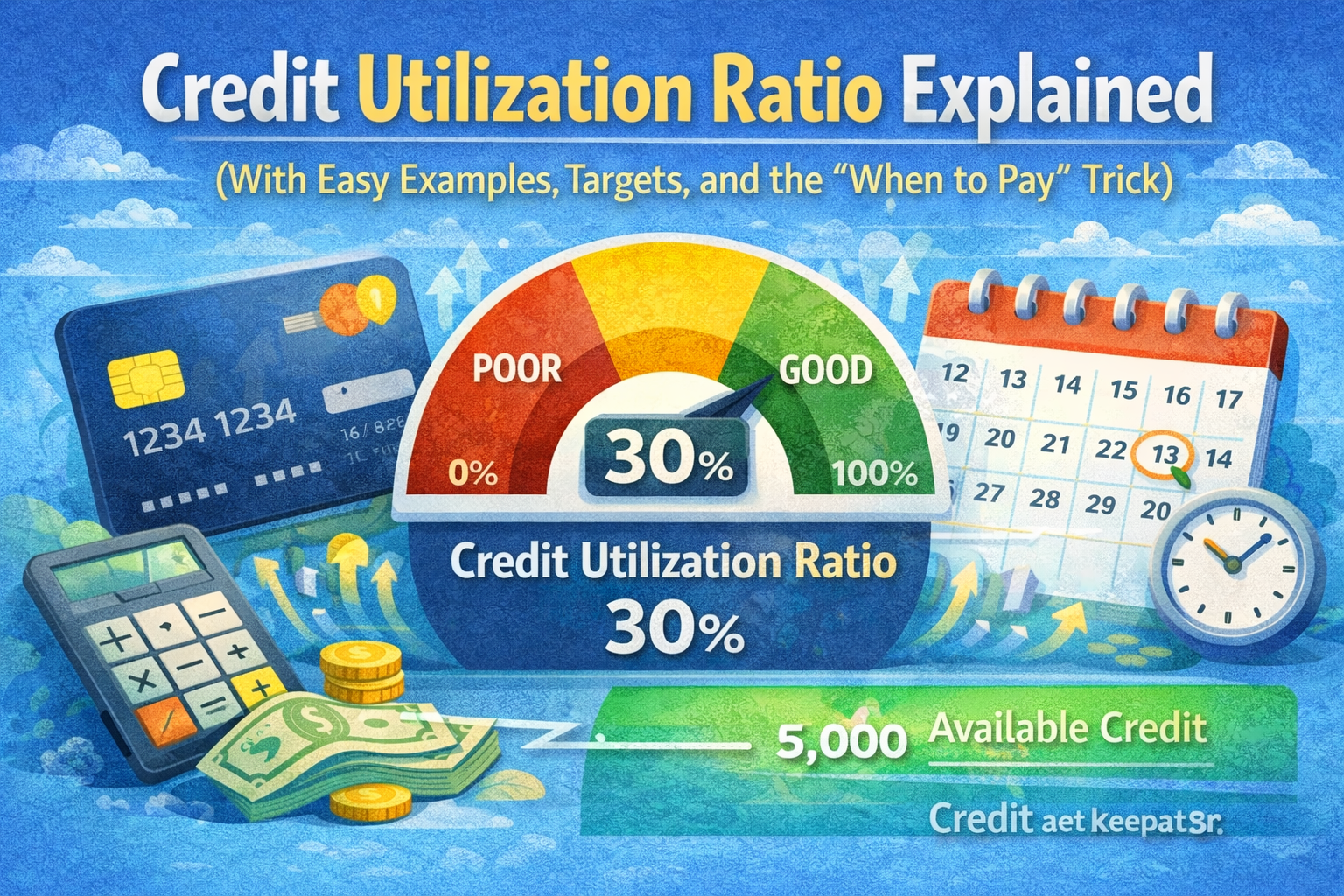

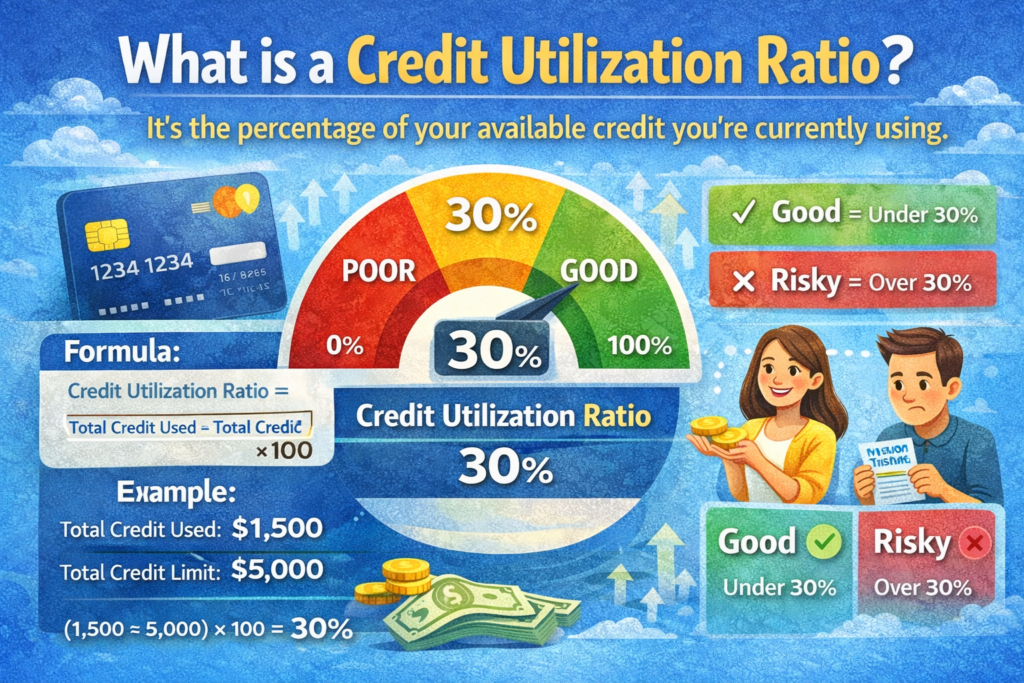

Credit utilization ratio = (credit card balances ÷ credit limits) × 100.

There are two important versions: overall utilization and per-card utilization.

As a general guideline, keeping utilization under 30% helps avoid bigger score drops, and people with the highest scores often stay below 10%.

Counterintuitively, 0% utilization is not “better than perfect” in many scoring situations; 1% can score better than 0%.

The fastest way to improve utilization is paying before your statement closes, because that’s what typically gets reported.

What is a credit utilization ratio?

Your credit utilization ratio is the percentage of your available revolving credit (mainly credit cards and lines of credit) that you’re currently using.

Example definition in plain English

If your cards add up to $10,000 in total limits and your reported balances add up to $2,000, you’re using 20% of your available credit.

Utilization matters because it’s part of the “amounts owed” category, which is a major factor in credit scoring (about 30% for FICO).

How to calculate credit utilization

There are two calculations you should know.

1) Overall utilization

Overall utilization uses all your credit cards together.

Formula

Total reported balances ÷ Total credit limits × 100

Example

Card A: $500 balance / $2,000 limit

Card B: $300 balance / $1,000 limit

Card C: $0 balance / $2,000 limit

Total balances = $800

Total limits = $5,000

Overall utilization = $800 ÷ $5,000 = 0.16 = 16%

This is exactly how many consumer education guides describe it: divide total balances by total limits.

2) Per-card utilization

Per-card utilization looks at each card individually.

Formula

That card’s reported balance ÷ That card’s limit × 100

Example

If one card has a $1,000 limit and reports a $450 statement balance, that card’s utilization is 45%.

Important: you can have a “good” overall utilization but still hurt yourself if one card is maxed out. That’s why you want to manage both overall and per-card usage.

What credit utilization should you aim for?

There is no single perfect number, but these targets are practical and widely recommended.

Beginner-safe target (avoid major damage)

Keep overall utilization below 30%

The CFPB describes keeping utilization under 30% as a sign to lenders that you’re using credit responsibly and still have available credit.

This is the “don’t get hurt” target.

Strong target (score-friendly)

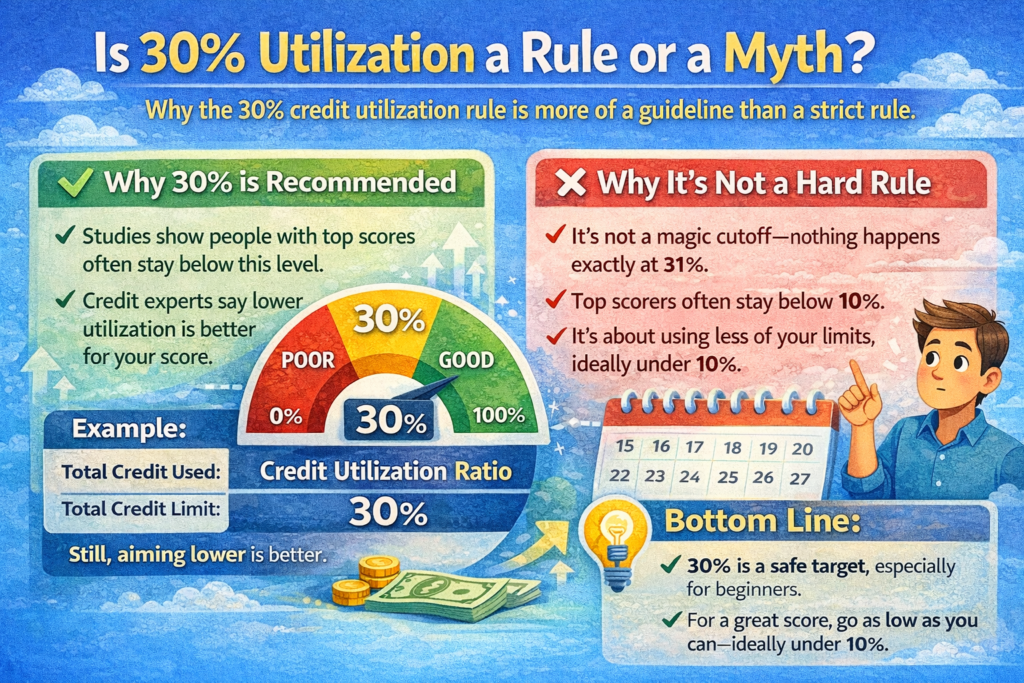

Keep overall utilization under 10%

Experian notes that people with the highest scores tend to have utilization below 10%, and the lower the better.

This is the “optimize” target.

Best practice for per-card utilization

Try to keep each individual card below 30% (and ideally below 10%) by the time it reports

Even if your overall is low, a single card reporting very high can look risky.

Here is a practical target table you can follow.

| Goal | Overall utilization target | Per-card target |

|---|---|---|

| Building credit / staying safe | Under 30% | Under 30% |

| Improving a “good” score | Under 10% | Under 10% |

| “I want my score to look its best next month” | 1–9% (not 0%) | Keep any single card from reporting high |

Is 30% utilization a rule or a myth?

It’s a guideline, not a magic cliff.

You won’t instantly “fail credit” at 31%. But crossing higher thresholds can have a bigger negative effect, and staying under 30% is an easy, widely used benchmark. The CFPB explicitly mentions under 30% as a responsible range for utilization.

If you want to be conservative, treat 30% as your ceiling and aim lower when you can.

Is 0% utilization best?

Usually no.

This surprises a lot of beginners. If you make all your cards report $0, you might expect your score to go up. But Experian explains that 0% utilization can be worse than 1% because scoring models want to see some recent usage and repayment behavior.

Practical takeaway

If you’re trying to “optimize” your score (for a loan or apartment), it can help to let a small balance report on one card (like 1% of the limit) and pay everything else down.

You can still avoid interest by paying the statement balance in full by the due date. Utilization is about what reports, not whether you pay interest.

When is utilization reported?

Most people pay on the due date and assume that’s what the bureaus see. Often, it isn’t.

Experian explains that credit utilization calculations typically use your most recent statement balance as it appears in your credit report.

They also note that balances are often reported weeks before the bill due date, which is why you can show high utilization even if you always pay in full.

Practical takeaway

If your goal is a lower utilization number on your credit reports, the move is paying the balance down before the statement closes (or soon before your issuer reports).

“I pay in full every month. Why is my utilization still high?”

Because utilization is usually based on the statement balance that was reported, not your current balance today.

Example

You charge $900 on a $1,000-limit card during the month. Your statement closes showing $900. That $900 is what often gets reported, creating 90% utilization, even if you pay the full $900 a week later.

That’s why people who always pay in full can still see a score dip if their statement closes with a large balance.

Fix

Pay part (or all) of the balance before the statement closing date so the statement balance is lower.

Easy examples (real-life scenarios)

Example 1: One card, small limit, big score swing

Limit: $500

Statement balance reported: $450

Utilization: 90%

Even if you pay the $450 in full by the due date, that month’s report still shows you used 90% of your available credit, which can hurt.

Better approach

Pay $400 before the statement closes, letting $50 report.

New utilization: $50 ÷ $500 = 10%

Example 2: Multiple cards, overall looks fine, one card looks risky

Card A: $0 / $3,000

Card B: $900 / $1,000 (90%)

Card C: $0 / $1,000

Overall: $900 ÷ $5,000 = 18% (looks good)

But one card at 90% can still raise flags.

Better approach

Split spending or pay early so no single card reports extremely high.

Example 3: You want “best-looking credit” for next month

You’re applying for a car loan or apartment in 30–45 days.

Goal

Overall utilization in single digits, and avoid 0% across all cards.

Action plan

Pick one card to report a tiny balance (example: $10–$30) and pay the rest to $0 before statements close. This lines up with guidance that 0% isn’t necessarily better than 1%.

How to lower your utilization quickly

Here are the strategies that actually move the needle.

Pay before the statement closing date

This is the fastest and simplest fix because utilization is based on what gets reported from your statement balance.

If you don’t know your statement date, look at your last statement PDF or your card app. It’s usually different from the due date.

Make two payments per month

If you’re a heavy card user (or your limit is low), paying twice a month keeps your reported balance from ballooning.

Simple cadence

Pay mid-cycle, then pay again right before the statement closes.

Ask for a credit limit increase (if your spending is stable)

A higher limit can lower your utilization if your balances stay the same. Investopedia describes credit limit increases as a way to reduce utilization and potentially improve credit scores, with the reminder that overspending can cancel the benefit.

If you request one, ask whether it triggers a hard inquiry (some issuers do, some don’t).

Avoid closing old cards (unless there’s a real reason)

Closing a card can reduce your total available credit and increase utilization. Investopedia notes that closing old cards can hurt your score partly through utilization changes.

If a card has no annual fee and you can manage it responsibly, keeping it open often helps your utilization math.

Fix credit report errors that inflate utilization

Sometimes utilization looks high because a limit is reported incorrectly (or not reported). Pull your reports and check that limits and balances match your statements.

Does utilization “reset” every month?

Mostly, yes.

Utilization is highly time-sensitive. When a new statement balance is reported, utilization recalculates. That’s why it’s one of the few factors you can improve quickly.

One important update: newer scoring models can consider trends over time. Experian notes that newer models such as VantageScore 4.0 and FICO 10 T may consider trended data, including average utilization over time.

Practical takeaway

Even if utilization resets monthly, consistently running high balances may matter more in newer models than it did years ago.

Does utilization apply to loans

When people say “utilization,” they usually mean revolving credit (credit cards). Installment loans are evaluated differently (your remaining balance vs original loan, payment history, etc.).

If your main problem is credit cards, focus on revolving utilization first. It’s the fastest mover.

FAQs (beginner ask for)

What is a good credit utilization ratio?

A practical range is under 30% to avoid bigger negative effects, and under 10% if you’re aiming for top-tier scores.

If you want your score to look its best in the short term, avoid having every card report $0; 1% can be better than 0%.

Should I keep utilization under 30% on every card, or just overall?

Both matter in real life. Overall utilization is important, but a single card reporting very high can still look risky. A simple best practice is keeping each card under 30% (and ideally lower) by the statement date.

Why did my score drop after I paid off my credit cards?

Common reasons include:

Your statement balance was still high when it reported (timing issue).

All your cards reported $0 (0% utilization can be less helpful than a small reported balance).

A different factor changed (new inquiry, new account, or an error on your report).

Does paying early hurt anything?

No. Paying early can help your utilization because it reduces the statement balance that gets reported.

Just make sure you still pay at least the statement balance by the due date so you avoid interest.

Can I use my card a lot if I pay it off right away?

Yes, as long as what gets reported stays reasonable.

You can spend $2,000 a month on a card with a $2,000 limit and still report low utilization if you make payments before the statement closes. Utilization is about reported balances relative to limits.

How fast can utilization changes improve my score?

Often within the next reporting cycle, because utilization is recalculated when new statement balances are reported. (Exact timing depends on when each issuer reports.)

Conclusion

Credit utilization is simple math, but it has an outsized impact because “amounts owed” is a major scoring category and utilization can change month to month.

If you take nothing else from this article, use this practical formula:

Keep overall utilization under 30% for safety, under 10% for strong scoring.

Pay before your statement closes if you want the reported balance to look lower.

Do not chase 0% across every card; a tiny reported balance can be better than none.