Written by Mrhamza, Credit Score Educator for Beginners

What Is a Credit Score? If you’re new to credit, “credit score” can sound like a secret number everyone else understands except you.

Maybe you’ve heard things like:

- “You need a good credit score to buy a house.”

- “One mistake can ruin your credit for seven years.”

- “My score just dropped 50 points and I don’t even know why.”

But no one has ever sat down and said, “Okay, here’s how this actually works — in normal.”

That’s what this guide does.

- No shame.

- No jargon overload.

- Real numbers, real examples.

- And links to official sources, not random rumors on social media.

1. What Is a Credit Score, Really?

Let’s strip it down:

A credit score is a number, usually between 300 and 850, that estimates how likely you are to pay back money you borrow on time. Consumer Financial Protection Bureau+1

Lenders (like banks, credit card companies, auto lenders, and sometimes landlords) use this number to decide:

- Should we approve you?

- How much can we lend you?

- What interest rate should we charge?

You can think of it like:

- Your financial GPA — based on your past behavior with credit.

- Higher score = you look safer to lenders.

- Lower score = you look riskier.

Important: Your credit score is not a judgment of your worth as a person. It’s just a statistical guess based on your past credit behavior.

2. Where Does Your Credit Score Come From?

Your credit score doesn’t appear out of thin air. It’s built from your credit reports.

In the US, there are three main credit bureaus:

- Equifax

- Experian

- TransUnion

They collect info like:

- What credit accounts you have (cards, auto loans, student loans, etc.)

- How much you owe

- Whether you pay on time

- If you’ve had collections, charge-offs, or bankruptcy

Then scoring companies like FICO and VantageScore run this data through their formulas and create your score.

Credit report = your detailed history.

Credit score = your history turned into a single number.

According to FICO, most scores use a 300–850 range, and a “good” score is often somewhere around 670–739. myFICO

3. Credit Score Ranges (Simple Table for Beginners)

Different models classify scores slightly differently, but for a typical 300–850 score, ranges look roughly like this:

| Range | General Label | What It Signals to Lenders (Very Simple) |

|---|---|---|

| 300–579 | Poor | High risk – big problems in the past or right now |

| 580–669 | Fair | Some issues – but you may still get approved |

| 670–739 | Good | Responsible borrower, usually approved |

| 740–799 | Very Good | Low risk, better interest rates |

| 800–850 | Excellent | Very low risk, best offers and rates |

Beginner goal: Don’t stress about hitting 800+. A realistic early goal is to move into and stay in the “Good” range and build from there over time.

🔍 Visual idea for your blog:

Add a horizontal bar graphic from 300 → 850, colored like a speedometer, with labels “Poor / Fair / Good / Very Good / Excellent”.

4. Why Your Credit Score Matters in Real Life (Not Just On Paper)

You might be thinking:

“Can’t I just use debit and ignore credit?”

You can, but in the US, your credit score affects a lot more than just credit cards.

4.1 Approvals and Interest Rates

When you apply for:

- Credit cards

- Car loans

- Personal loans

- Mortgages

Lenders almost always check your credit score.

Higher score:

- Easier to get approved

- You usually get lower interest rates

Lower score:

- More likely to get denied

- If approved, likely to get higher interest rates

4.2 How Your Score Changes Real-Life Money: Car Loan Example

Let’s say two people buy the same $15,000 car with a 5-year loan:

- Person A has a good credit score and gets a 6% interest rate.

- Person B has a poor/fair score and gets a 14% interest rate.

Here’s what that looks like in dollars (rounded):

| Person A (6%) | Person B (14%) | |

|---|---|---|

| Monthly payment | ≈ $290 | ≈ $349 |

| Total paid over 5 years | ≈ $17,400 | ≈ $20,941 |

| Total interest paid | ≈ $2,400 | ≈ $5,900 |

That’s roughly $3,500 more in interest for the same car, just because of a worse credit score.

That’s why people say your credit score can “save or cost you thousands.”

🔍 Visual idea:

Turn that table into a side-by-side bar chart: “Interest paid at 6% vs 14% on a $15,000 car loan”.

4.3 Renting an Apartment

Many landlords and property managers run a credit check when you apply for an apartment.

- Good credit: easier approvals, smaller deposits.

- Poor credit: bigger deposit, co-signer required, or sometimes rejection.

4.4 Cell Phone Plans, Utilities, and More

Some phone companies, internet providers, and utility companies check your credit too. With weak credit, you might have to:

- Pay a bigger deposit

- Prepay for services

5. Big Picture: Millions of Americans Are Affected

You’re not the only one dealing with this.

- A CFPB report estimated that around 188 million Americans have credit records that can be scored by a major model, and millions more are “credit invisible” — they have no usable credit history at all. Consumer Financial Protection Bureau

- Medical debt has been such a problem that in 2025 a new federal rule banned unpaid medical bills from appearing on credit reports, affecting about 15 million people and potentially raising their scores by about 20 points on average. AP News+1

So if your credit feels messy, confusing, or stressful: you’re very normal.

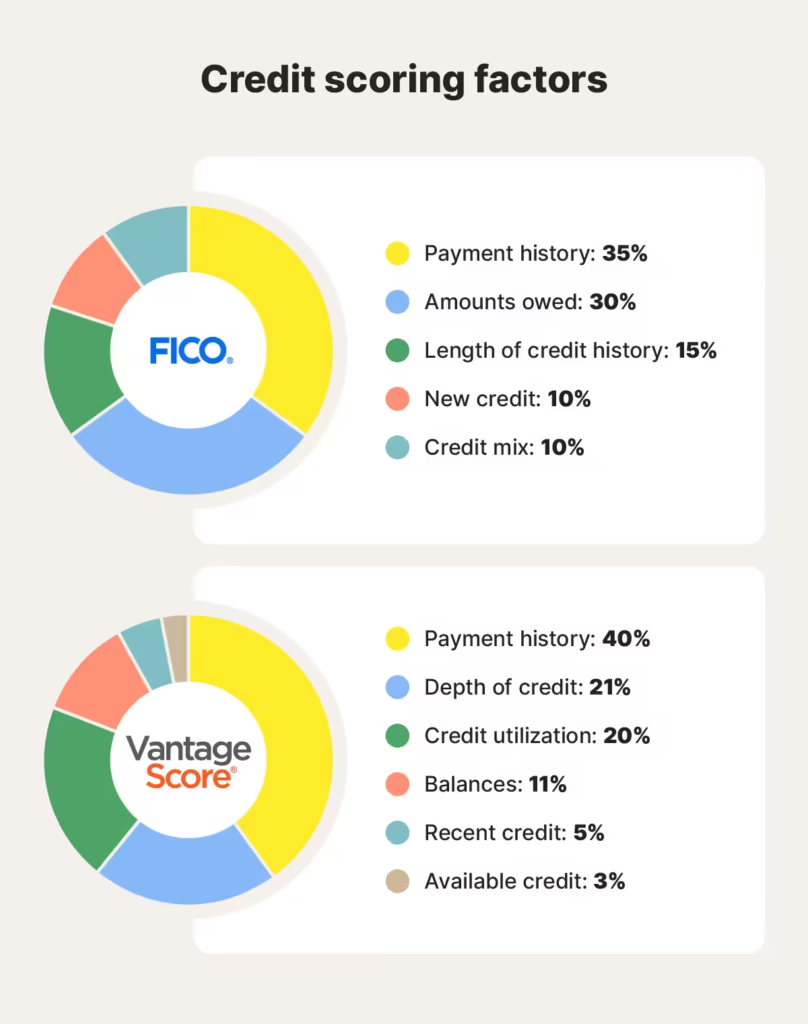

6. What Actually Affects Your Credit Score? (The 5 Key Factors)

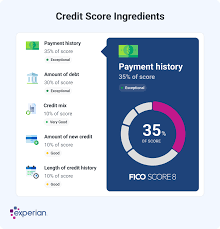

Most scoring models (like FICO) look at similar main ingredients. Here’s a beginner-friendly breakdown.

6.1 Payment History – Do You Pay on Time? (Most Important)

This is the single biggest factor.

Lenders want to know one thing:

“When you say you’ll pay us back, do you actually do it — and on time?”

- On-time payments = good for your score

- Late payments (30+ days overdue) = very bad, especially repeated ones

- Collections, charge-offs, and bankruptcies = heavy long-term damage

The Consumer Financial Protection Bureau (CFPB) warns that paying on time, every time is one of the most powerful ways to build and keep a good score. Consumer Financial Protection Bureau+1

Beginner move: If you only do one thing, set up automatic payments or reminders so you never miss due dates.

6.2 Credit Utilization – How Much of Your Available Credit You Use

This mostly applies to credit cards.

Example:

- Card limit: $1,000

- Balance: $800 → utilization = 80% (too high)

- Balance: $200 → utilization = 20% (much healthier)

Beginner rule of thumb:

- Try to keep utilization under 30% overall

- Under 10% is even better if you’re aiming to maximize your score

When you’re close to maxed out, scoring models see you as riskier, even if you never miss a payment.

6.3 Length of Credit History – How Long You’ve Been Using Credit

Score models look at:

- How long your oldest account has been open

- The average age of all your accounts

Because you’re a beginner, this part will naturally be weak at first. That’s okay.

The key idea:

Don’t constantly open and close accounts if you don’t need to. Let some good, healthy accounts age.

6.4 Credit Mix – Types of Credit You Use

Two main types:

- Revolving credit – credit cards

- Installment loans – car loans, student loans, mortgages, personal loans

Having a mix can help a bit, but it’s not the most important factor. It’s not worth taking a loan you don’t need just for “credit mix”.

6.5 New Credit & Hard Inquiries – How Often You Apply

Every time you apply for a new card or loan, the lender may perform a hard inquiry.

- A few hard inquiries = normal

- Lots in a short time = looks like you’re desperate for credit

Hard inquiries can cause a small, temporary drop in your score.

Soft inquiries (like checking your own score or getting pre-qualified offers) do not affect your score.

7. Common Myths Beginners Believe (And What’s Actually True)

Myth #1: “Checking my own credit score will hurt it.”

False.

When you check your score through a bank, app, or legitimate service, that’s a soft inquiry and doesn’t hurt your score. Consumer Advice+1

You should check your score — it’s like stepping on a scale before starting a workout plan.

Myth #2: “I have to carry a balance or pay interest to build credit.”

False.

You do not need to stay in debt or pay interest to build a good score.

You can:

- Use your credit card for normal things (gas, groceries, subscriptions).

- Pay the full balance every month.

- Still build credit while paying $0 in interest.

Myth #3: “My income decides my credit score.”

False.

Your income isn’t in your credit report and isn’t directly part of your score. What matters more is:

- Paying on time

- Keeping balances reasonable

- Avoiding serious negatives like collections and defaults

You can have:

- A high income and a bad score

- A modest income and a great score — if you’re careful

Myth #4: “Once my score is bad, it’s over.”

False.

Negative marks can stay for years, but your score can improve as new, positive history is added.

If you:

- Start paying on time

- Pay down balances

- Stop adding new late payments

…your score can gradually move up. It won’t be overnight, but it is absolutely possible.

8. How to Check Your Credit Reports and Scores (Using Official Sources)

Let’s separate reports and scores:

8.1 Getting Your Credit Reports (The Detailed History)

By US law, you can get free credit reports from each of the three major bureaus once every 12 months. The federal government points consumers to:

- AnnualCreditReport.com – the only website explicitly authorized for the free annual reports

- You can also call or mail in a request, as explained by the FTC and USA.gov. USAGov+2Consumer Advice+2

This shows you:

- Your accounts

- Balances

- Payment history

- Any negative items

- Possible errors you may want to dispute

8.2 Getting Your Credit Score

Your exact score can vary depending on the model and lender, but you can usually see a free educational score through:

- Your credit card account (many display a free FICO or VantageScore)

- Your bank or credit union

- Reputable credit monitoring sites or apps

- Paid access directly from Equifax, Experian, or TransUnion USAGov

The score you see might not be the exact number a specific lender uses, but it’s close enough to:

- Track your progress

- Know whether you’re in “good”, “fair”, or “poor” territory

9. Step-by-Step: How a Beginner Can Start Improving Their Credit Score

Here’s a simple starter plan you can actually follow.

Step 1 – See Where You Stand

- Pull your free reports from AnnualCreditReport.com.

- Check your score through your bank or card app.

- Look for:

- Accounts you don’t recognize

- Late payments

- Collections

- High credit card balances

Step 2 – Fix the “Big Ugly” Stuff First

If you see errors (accounts that aren’t yours, wrong late payments, etc.), you can dispute them with the bureaus. The CFPB and FTC both offer step-by-step guides for disputing errors. Consumer Financial Protection Bureau+1

If you see legitimate late payments or collections, focus on:

- Getting current on anything overdue

- Communicating with creditors or collectors for realistic payment plans

Step 3 – Set Up On-Time Payments (Non-Negotiable)

Use:

- Auto-pay for at least the minimum payment

- Calendar reminders

- Email alerts and app notifications

CFPB materials emphasize that paying bills on time — every time — is one of the most effective ways to build a strong score. Consumer Financial Protection Bureau+1

Step 4 – Lower Your Utilization

If your cards are near maxed out:

- Try to pay more than the minimum when you can

- Pause new unnecessary spending on those cards

- If you get a windfall (bonus, tax refund, side gig money), consider throwing some at your highest-interest card

Your utilization doesn’t have to hit 0%, but dropping it under 30% overall is a big win, and lower is even better.

Step 5 – Be Strategic About New Credit

As a beginner, you might need:

- A starter credit card

- Or a secured card (you put down a deposit and get a small credit limit)

But after you have an account or two:

- Avoid applying for lots of new credit in a short time

- Let your good accounts age

10. Quick Beginner FAQ

Q1: Is having no credit history the same as a bad credit score?

No. No history usually means you don’t have enough data to generate a score yet. Bad credit means there is data, and it shows serious issues (late payments, collections, etc.).

Q2: How often does my credit score change?

Your score can change whenever new info hits your reports — usually once a month or so when creditors update balances and payments.

Q3: Does rent help my credit score?

Sometimes. Rent doesn’t always appear on your credit reports by default. Some services can report your rent payments to the bureaus, which may help with certain scoring models.

Q4: How long do negative marks stay?

It depends:

- Late payments – often up to several years

- Collections & charge-offs – several years

- Bankruptcies – longer than most other items

Their impact tends to weaken as they age and as you add more positive history.

Q5: What about medical bills on my credit report now?

Under a new federal rule finalized in 2025, unpaid medical bills are being banned from credit reports, aiming to remove around $49 billion in medical debt and help about 15 million Americans. AP News+1

That means your score should more accurately reflect your credit behavior, not whether you got hit with a giant medical bill.

11. Wrap-Up: You Don’t Have to Be Perfect to Have Good Credit

If credit scores make you anxious, here’s the good news:

- You don’t need to understand every tiny detail of every model.

- You don’t need to be rich.

- You do need a few solid habits and a basic understanding — which you now have.

Key takeaways for beginners:

You have legal rights to free credit reports and access to your scores from multiple sources.

Your credit score is just a number that predicts risk, not your value as a person.

It’s mainly driven by paying on time and how much of your available credit you use.

Small changes (like lowering card balances and never missing due dates) can save you thousands in interest over your life.